by Ben Weiss, for the Call to Leap Team

With a few weeks of upward market momentum under our belt, Steve and I took a few bullish positions this week. However, with major indices like the S&P 500 and Nasdaq at or near their all-time highs, we'll be careful and thoughtful in our investing outlook moving forward. While the bullish trend could certainly continue, these all-time highs could alternatively act as bearish resistance limiting the market from advancing higher in the short term.

Historically, May to October have been lower-performing months for the market, lending to the old adage "sell in May and go away." At CTL, Steve and I follow the dollar cost average approach and try not to "time the market" and its ups and downs, however we shouldn't be surprised if we see a bit of slow down ahead. Overall, I'm with many investors in being bullish for the remainder of 2024, but we'll pay attention to the market trends and use the various tools in our options trading toolbox as needed.

Ben’s trades this week

Take it and run... I took the opportunity to buy to close (BTC) my puts in GOOGL, TQQQ, and AMD early for 60-80% profit, thanks to the surge in the technology sector late this week. Each of those puts had over a month to go until their June 21 expiration, so it wasn't worth it to me to wait quite a bit longer to pocket that last slice of profit while keeping all that risk on the table.

GOOGL: Buy to close 1 June 21 $160 strike put option. Release $16,000 collateral back to my account.

TQQQ: Buy to close 1 June 21 $50 strike put option. Release $5,000 collateral back to my account.

AMD: Buy to close 1 June 21 $155 strike put option. Release $15,500 cash collateral back to my account.

With my AMD position, specifically, I actually held 2 CSPs and decided to scale out of my position slowly. Since the puts had only gained about 60% profit and AMD continues to trend sharply bullishly, I decided to BTC only 1 of my put contracts and keep the other open to squeeze a bit more profit out of the position. Just like we can scale into positions slowly to reduce or distribute risk, we can scale out of positions too, in reverse. With NVDA earnings coming up this week, I knew I wanted to take at least some profit and reduce my risk (NVDA earnings could drag AMD stock price along with it, for better or worse). Given the opportunity, I may look to BTC my final AMD put before NVDA earnings early this week.

Big wheel keep on turning... This week, one of my AAPL covered calls at $180 was due to expire. Given that AAPL is now well above $180 level, I decided to let this call be assigned, let my 100 shares go, and take the $18,000 capital and invest it elsewhere. I also already received my quarterly AAPL dividend which went ex-dividend on May 10, so I wouldn't be due additional dividends for 3 more months. I have other AAPL covered calls remaining open so taking assignment here on 1 contract was a good way to reduce my account's weighting in AAPL and diversify elsewhere.

New Trade 1: SOXL cash-secured put (CTL Level 1)

🚨🚨Caution: trading leveraged ETFs options is a more advanced, risky strategy and not for everyone, especially beginners. Please consider/tweak these positions as they fit your risk tolerance and trading style.🚨🚨

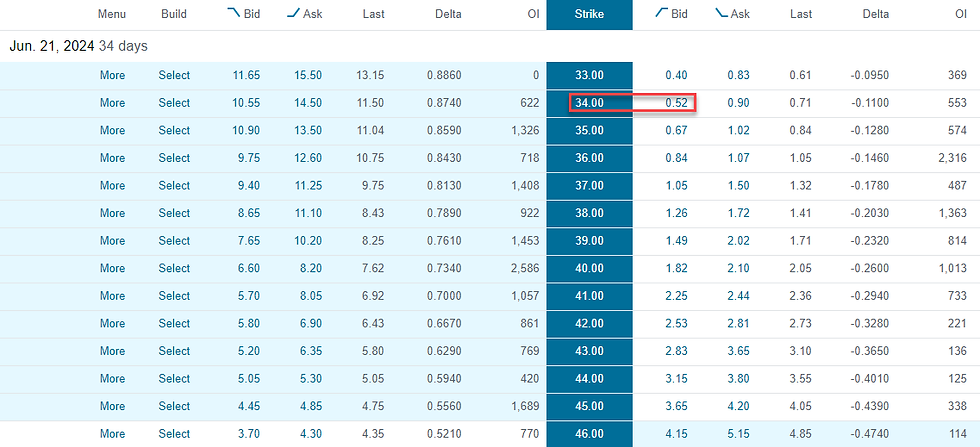

Expiration Date: June 21, 2024 (a "monthly" expiration)

Step 1: Have $3,400 cash as collateral

Step 2: Sell to open 1 $34 strike put option (delta 0.11) for $0.71/share (bid price is showing as $0.52 but my fill price was closer to the mid price at $0.71. I'm not sure why the bid/ask spread is showing as so wide.)

Credit/premium received: $71/contract (minus fees and commissions)

Thoughts: After studying and watching SOXL for a few weeks, I decided to trade this leveraged ETF for the first time, in addition to my trading on TQQQ. SOXL tracks the semiconductor industry (check out the unleveraged ETF "SOXX"). Similarly to TQQQ, this ETF moves very fast, both up and down, but can also be a less capital intensive way to trade the volatility in the semiconductor industry, compared to NVDA, SMCI, AMD, TSM, and other expensive stocks. I only trade this volatile ETF when I'm confident I'll be able to monitor my positions throughout the week. If you're a once-a-week "set it and forget it" style trader, this ETF may not be for you. Looking at the ETF technically, I'm seeing strong support around the $34 level and chose that strike to be extra safe with NVDA earnings coming up. The $36 put option could also be a good choice given its much higher open interest (almost 5x as many contracts as the $34 level).

🚨🚨🚨The typical caution for leveraged ETFs: If you're not familiar with TQQQ or SOXL, they are ETFs that follows the movement of the Nasdaq index fund "QQQ" and semiconductor ETF "SOXX", respectively. However, because they are 3x leveraged, they will increase or decrease 3 times the movement of QQQ or SOXX. By nature, trading in leveraged ETFs can be highly volatile and isn't for everyone! I like trading them because of their much lower share price compared to QQQ, NVDA, etc., making it a more accessible way to trade in the broader technology industry. Please reach out with any questions! 🚨🚨🚨

New Trade 2: AMZN LEAPS call (CTL Level 2)

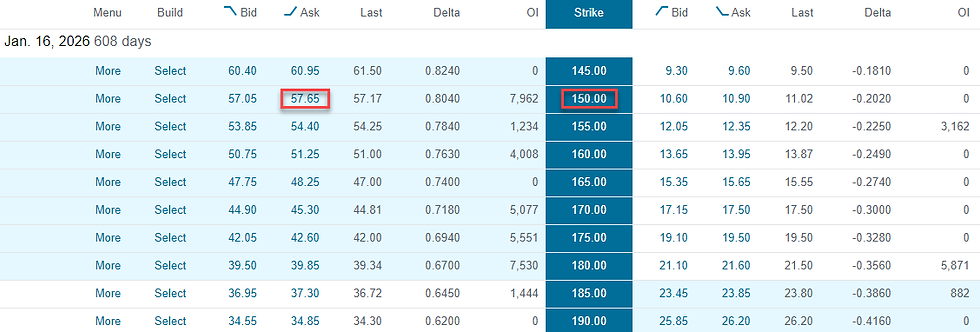

Expiration Date: January 16, 2026 (1.5-year expiration)

Step 1: Have $5,765 cash

Step 2: Buy to open 1 $150 strike LEAPS call option (delta 0.80) for $57.65/share

Debit/premium spent: $5,765/contract (plus fees and commissions)

Thoughts: Steve and I are both bullish on AMZN. I see some headroom for AMZN to grow in its upward trending channel, however I'm prepared to hold onto the LEAPS option for 1 or more financial quarters if needed to turn profitable. Ideally, I can close this out for 10%+ profit in the next few weeks. Remember, buying LEAPS is a risker strategy than the Wheel Strategy as we're not guaranteed to make any profit (unlike receiving premium for selling options) and theta decay is not working in our favor.

In it for the long-haul...Even though I didn't open a new options positions this week, as always, I held true to the dollar-cost average (DCA) method and bought a few shares each of SPY, QQQ, SCHD. The DCA method allows me to check my uncertainty at the door about whether now is a good time buy or not, especially with so much perceived uncertainty right now. Who knows if the market will go up, down, or sideways? All I know is I'll continue to be disciplined about saving and investing no matter what.

Steve's trades this week

New Trade 1: AMZN LEAPS call (CTL Level 2)

Expiration Date: June 18, 2026 (2-year expiration)

Step 1: Have $6,865 cash

Step 2: Buy to open 1 $140 strike LEAPS call option (delta 0.83) for $68.65/share

Debit/premium spent: $6,865/contract (plus fees and commissions)

Thoughts: Ben and I are both bullish on AMZN, but I bought a different AMZN LEAPS than what he picked. I went further out in time and a bit deeper in-the-money. I want to hold onto AMZN for more than half a year (when Ben's Jan 2026 LEAPS would dip under the 1-year-to-expiration mark and no longer be a LEAPS) which is why I chose a 2-year expiration. We also have an election coming up in November and I want to be more prepared for volatility and time decay.

Go long!...I continued adding shares to my long-term positions this week, including some of my favorite stocks like COST, WMT, and AMZN, and some of Ben's and my favorite ETFs like SPY, QQQ, and SCHD.

As always, tweak these positions to whatever you feel comfortable with and fits your risk tolerance and investing goals.

You got this, everyone! Stay disciplined, pay yourself first, and always invest in your greatest asset—yourself. 🙌🏻

- Ben and Steve

Friendly reminders from Steve and Ben:

Check out Steve's favorite checking and savings accounts

Click here and here to see different accounts that could fit your banking needs. Offers including great sign-up bonuses and higher interest rates to let your money work harder for you.

💪💰 Do you have the power?...Based off the great recommendation from Steve and lots of folks in the CTL community, Ben recently signed up for budgeting app Empower to get a better dashboard picture of all his various accounts and has been really been enjoying how easy it is to use. If you'd like to give Empower a try, click here to check it out!

Let your money work harder for you...

I'm also getting nearly 5% APY by having my cash sit in my Fidelity account as I sell my cash-secured puts. Here's the link if you're interested in getting started!

Manage Your Cash Against Rising Costs | Compare Our Rate | Fidelity

📌Join Our Discord 💬

Investing, trading, and building wealth was a lonely journey for me. This is why my team and I created a Discord group for you and the other members to shares ideas and support one another. You don't have to go through it alone as we're all here to help. 😉

You can sign up here.

If you need help, feel free to send us a message.

Coming from a teacher's perspective, I believe it's important to engage in conversations with people who are also seeking to reach financial freedom.

Remember that we are a community of wealth builders at all different levels, so be positive, kind, and helpful to others, so we can help each other get to financial freedom much faster.

⚠️⚠️⚠️⚠️⚠️⚠️

Please make sure to NEVER give your personal information to anyone on Discord, especially anyone who may look like Steve or Ben. There are many impersonators on Discord who will ask you to click a link or give them money to invest, which we will NEVER do.

If someone messages you claiming to be Steve or Ben, always check that their username matches EXACTLY "SteveCTL" or "BenW." and they have the "Head Mod" tag in their profile.

If you're ever unsure, please stop and ask! We're always here to help. Stay safe everyone!

⚠️⚠️⚠️⚠️⚠️⚠️

Disclaimer:

The following article is strictly the opinion of the author and is to not be considered financial/investment advice. Call to Leap LLC and the author of this article do not claim to be a registered financial advisor (RIA) or financial advisor. Please visit our terms of service and privacy policy before reading this article.

"Call to Leap may earn affiliate commissions from the links mentioned. Call to Leap is part of an affiliate network and receives compensation for sending traffic to partner sites such as ImpactRadius, CardRatings, MyBankTracker, and more."