by Ben Weiss, for the Call to Leap Team

Happy Friday, everyone! And apparently, happy National Pizza Party Day too...say less! We're just a week away from the unofficial start of summer, and we've got lots to celebrate, including pizza...because why not? 🍕

Before I wish everyone a safe and fun weekend, let's take a look at what happened this week and what's coming up...

The market this week

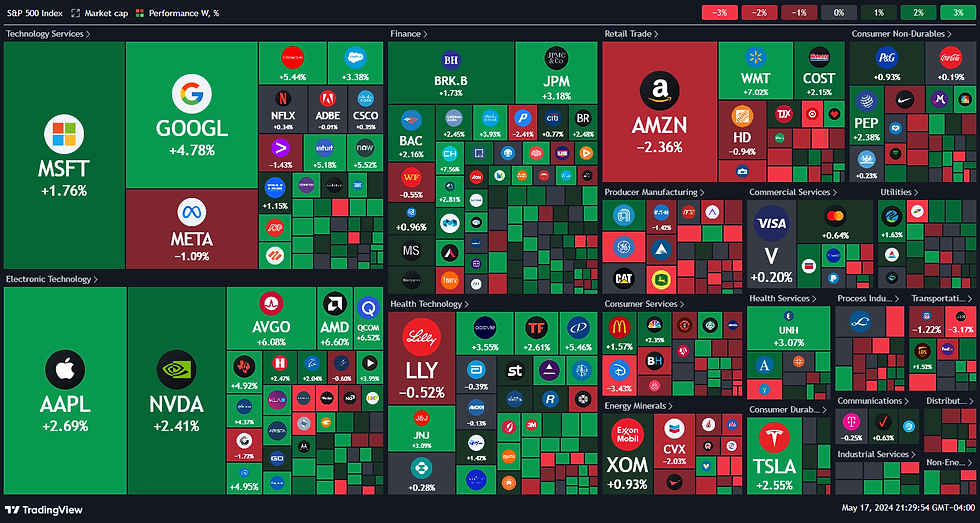

The market logged another positive, bright green week, building on previous upward momentum to close out a 4th consecutive week of gains. The Dow Jones, for the first time ever, pierced the $40,000 mark briefly on Thursday and then closed the week above that notable level on Friday. Not wanting to be left out of the party, the S&P 500 also registered a fresh all-time high this week above the $5,300 mark.

Elsewhere in the news, we heard patient, cautious optimism from Federal Reserve Chairman Jerome Powell, received Consumer Price Index (CPI) and Producer Price Index (PPI) reports, and learned about earnings performances from major US retailers Home Depot (HD) and Walmart (WMT).

By the numbers, the S&P 500 (+1.34%), DOW 30 (+1.04%), Nasdaq (+1.74%), Russell 2000 (+1.14%) all posted healthy gains for the week. Now that major market indices have rebounded back to their all-time highs (or even higher), let's see if this month-long bullish rebound continues into next week and beyond or if we'll once again see technical resistance around these levels.

To the charts

SPY

This week's price action picked up where last week's left off. Over the last 4 weeks, SPY has been forming a new upward sloping channel (in green on the far right). While the channel may be narrowing or "consolidating" somewhat, you can see the index had little difficulty passing through the previous all-time high of $525, failing to act as effective resistance.

The RSI or "Relative Strength Index" is right below 70 today, indicating we may potentially be approaching overbought territory. RSI is a momentum indicator that can provide us clues about whether a stock or index may be oversold (30 or below is a potential bullish signal) or overbought (70 or above is a potential bearish signal). This data certainly does not guarantee a bearish downturn coming up, but is another clue we can use to build our short-term outlook thesis.

QQQ

Like on the daily chart for SPY, we saw continued signs of a bullish trend for QQQ. The index managed to find enough upward momentum to push through the $450 resistance level from the all-time high back in March. The RSI is also around 70 as with SPY.

In the news

The price is right, right?... We received mixed CPI and PPI data this week, two measuring sticks the Federal Reserve prefers using to track progress towards bringing the US inflation rate down to 2%. On the consumer side (what we pay for goods and services), prices increased 0.3% in March, slightly below expectations of a 0.4% increase. When we remove the more-volatile food and energy prices from the calculation (giving us what's called "Core CPI" data), we saw the lowest year-over-year reading since April 2021. As Powell said, the effort to bring inflation under control isn't a straight line, but we're making progress nonetheless.

Producer or "wholesaler" prices (PPI) came in well higher than expected, increasing 0.5% for April compared to the expected 0.3% and 2.2% year-over-year, the biggest jump in a year. Interestingly, however, the Labor Department revised March data from a 0.2% increase down to a 0.1% decrease. 👀

The market appeared to digest and quickly shrug off any negative aftertaste from the CPI and PPI data, as the bullish rally continued consistently throughout the week.

Re-tail as old as time... We received earnings reports from some mainstay big box stores this week.

Home Depot (HD) had mixed results, barely topping earnings per share (EPS) expectations by less that 1% and barely missing revenue expectations by a similarly slim margin. The company maintains its positive forecast but admits high interest rates have impacted their customers' spending. Home Depot's Chief Financial Officer Richard McPhail said, "The home improvement customer is extremely healthy from a financial perspective, so it’s not the case of not having the ability to spend. What they tell us is they’re just simply deferring these projects as given higher rates, it just doesn’t seem the right moment to execute.” Investors responded by selling the stock down up to 2% on Tuesday following the announcement.

Walmart (WMT) on the other hand had a blockbuster earnings report, beating EPS expectations by a whopping 14% and revenue by over 1%. The world's largest retailer made gains with high-income shoppers while also growing their e-commerce division by 22% since this time last year. The company's leadership noted that high prices for eating out at restaurants, even fast food chains, are driving more customers to save money and cook at home more. Shares surged over 7% on Thursday to an all-time high and continued higher yet to close out the week near $65.

Just you wait... Next week, the last of the biggie Magnificent 7 companies will report their quarterly earnings. As arguably the hottest stock of 2024, all eyes will be glued on NVDA when they announce Wednesday after market close.

You got this! Stay disciplined, pay yourself first, and always invest in your greatest asset—yourself. As always, let us know if you have any questions. 🙌🏻

-Steve & Ben

Friendly reminders from Steve and Ben:

Check out Steve's favorite checking and savings accounts

Click here and here to see different accounts that could fit your banking needs. Offers including great sign-up bonuses and higher interest rates to let your money work harder for you.

💪💰 Do you have the power?...Based off the great recommendation from Steve and lots of folks in the CTL community, Ben recently signed up for budgeting app Empower to get a better dashboard picture of all his various accounts and has been really been enjoying how easy it is to use. If you'd like to give Empower a try, click here to check it out!

Let your money work harder for you...

I'm also getting about 5% APY by having my cash sit in my Fidelity account as I sell my cash-secured puts. Here's the link if you're interested in getting started!

Manage Your Cash Against Rising Costs | Compare Our Rate | Fidelity

📌Join Our Discord 💬

Investing, trading, and building wealth was a lonely journey for me. This is why my team and I created a Discord group for you and the other members to shares ideas and support one another. You don't have to go through it alone as we're all here to help. 😉

You can sign up here.

If you need help, feel free to send us a message.

Coming from a teacher's perspective, I believe it's important to engage in conversations with people who are also seeking to reach financial freedom.

Remember that we are a community of wealth builders at all different levels, so be positive, kind, and helpful to others, so we can help each other get to financial freedom much faster.

⚠️⚠️⚠️⚠️⚠️⚠️

Please make sure to NEVER give your personal information to anyone on Discord, especially anyone who may look like Steve or Ben. There are many impersonators on Discord who will ask you to click a link or give them money to invest, which we will NEVER do.

If someone messages you claiming to be Steve or Ben, always check that their username matches EXACTLY "SteveCTL" or "BenW." and they have the "Head Mod" tag in their profile.

If you're ever unsure, please stop and ask! We're always here to help. Stay safe everyone!

⚠️⚠️⚠️⚠️⚠️⚠️

Disclaimer:

The following article is strictly the opinion of the author and is to not be considered financial/investment advice. Call to Leap LLC and the author of this article do not claim to be a registered financial advisor (RIA) or financial advisor. Please visit our terms of service and privacy policy before reading this article. "Call to Leap may earn affiliate commissions from the links mentioned. Call to Leap is part of an affiliate network and receives compensation for sending traffic to partner sites such as ImpactRadius, CardRatings, MyBankTracker, and more."